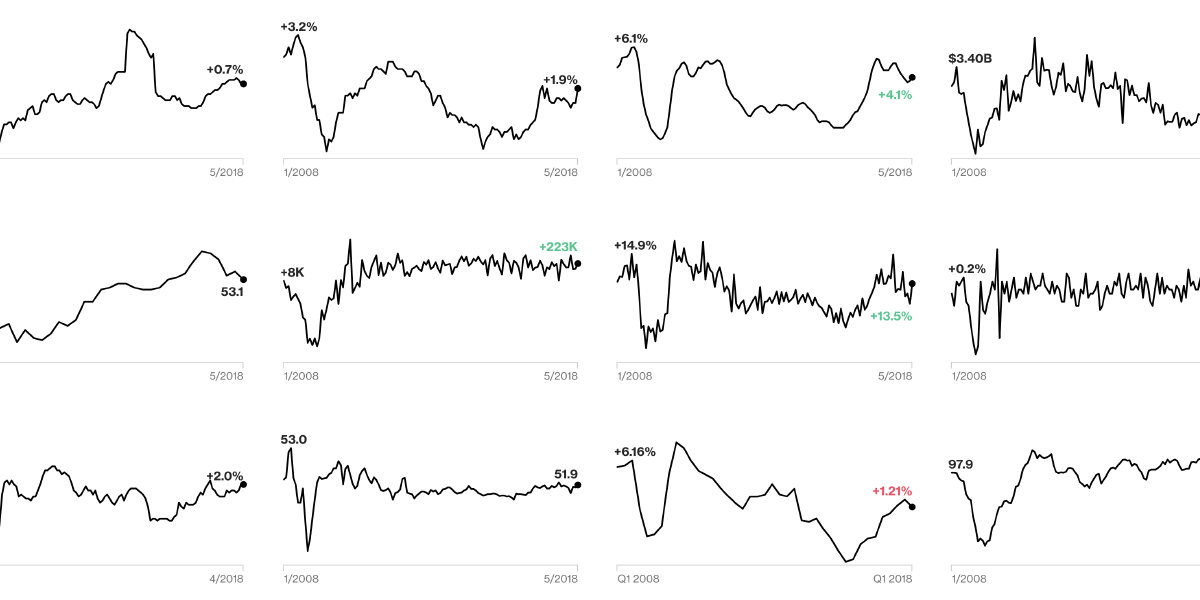

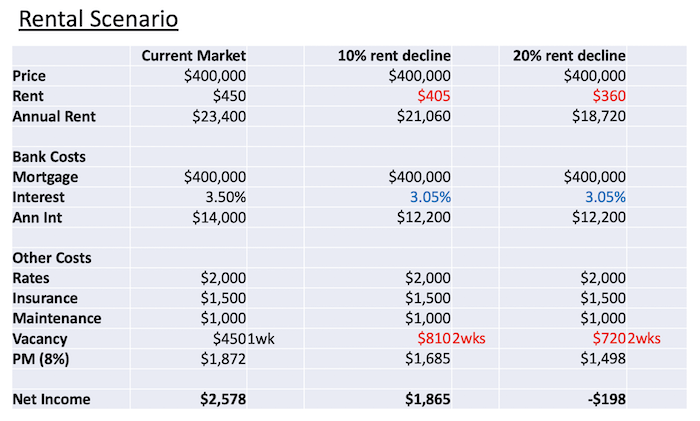

In which I dare to make an economic prediction

The old joke goes that economists have predicted 7 of the last 5 recessions. Since I have no qualifications as an economist whatsoever, I thought I would throw my hat into the ring and share a couple of "reckons" on why I think we are at, and now moving through, the bottom. Read More…