Why Christchurch and Its Surroundings Tick So Many Boxes for Property Investors in 2026

A 2026 insight into the Christchurch property market for investors. Read More…

by Nick Gentle on

Article appears under:

About Property Investment,

The Numbers

Hello investors!

Fresh from the coalface, here is what we are seeing, tracking and thinking about in property-land.

The old joke goes that economists have predicted 7 of the last 5 recessions. Since I have no qualifications as an economist whatsoever, I thought I would throw my hat into the ring and share a couple of "reckons" on why I think we are at, and now moving through, the bottom.

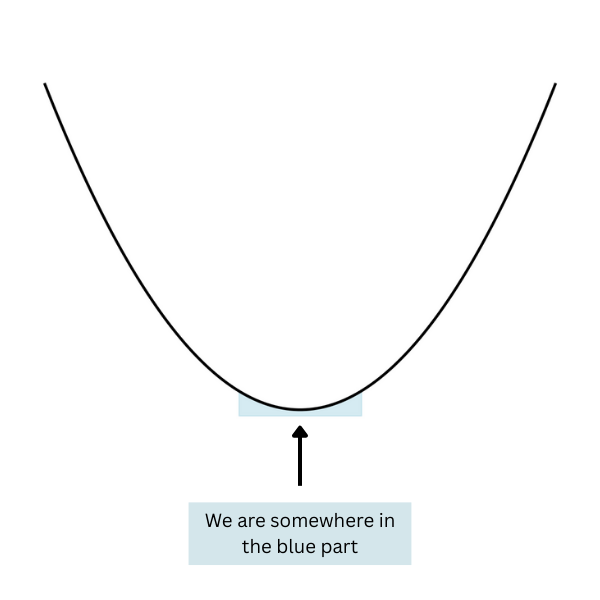

Before you send your letter to the editor in disgust... in my mind, the "bottom" is a curved parabola and not a pointy "V" so yes, there is going to be more bad economic news over the next 6 months. The recovery will be too late for some, and we will see closures, jobs lost, and restructures. There will be more businesses that have sadly passed a point from where recovery is not possible, and they lack the time, energy, or capital to stay active as the economy starts to pick up some steam. Construction is still in the doldrums, and related sectors like forestry and wood products have been hit hard by the construction pullback.

So why I am feeling more optimistic than the headlines in the Herald suggest I should be? Let me list some reasons...

Interest rates - last week June quarter GDP data

came in sharply down.

The economy has been bad. This will put pressure on both the RBNZ and the Government to move quickly and decisively.

But - and this is a big but - that data is now quite old. The June quarter is April 1 to June 30. Projections for more recent numbers are much rosier and some analysis has picked up on this.

House markets

Jobs - the biggie

and...

Farming - the other biggie

Student numbers - A hint in a recovery in university numbers outside of Christchurch?

What does all of the above mean for property investors? My team reports more competition for deals in just about every market, and once the collective decides that we are on the up, I think the market will quickly shift. If you are sitting on the fence, I wouldn't do it for too much longer.

A couple of counter-arguments...

The big "but" - 2026 is an election year

Oh joy, another election is coming up. The good news for us is that Labour will be forced to be transparent about any intended tax changes. We don't yet know what they will include in their campaign. Rumours are that they will once again campaign on some form of a CGT, which has proven to be unpopular every other time they have tabled it (Jacinda's "captains call", anyone?).

I have heard they might try to target some investment assets, which would create a real mess just like "bright line" turned into in their watch - when occasional use as holiday home got captured, moving to another city for a year, renting there and renting out your house got captured, "is it a house or a farm?", and all sorts of other fun. I'll wager a fiver that whatever Labour comes in with, they will lose the narrative in less than a week.

A material jobs numbers lift is also needed

Our population trends will not improve until there is a sustained period of job growth, and not just a month's worth of help-wanted ads on Seek. With the current success in the primary sectors, a lower NZD and lower interest rates, projections are much better going forward, but people will vote with their feet until there is a reason not to.

The most important idea - do it right and you'll do well in any market

iFindProperty made its name by knowing where to invest to capture some growth, where for cashflow, how to add both in a deal, and to make sure you buy well in the given market you choose. I've been doing this for long enough to know you can do badly in a hot market and amazingly well in a market that looks to be underperforming, so you can get a lot more certainty in your outcomes by working with a professional investor buyer's agent from our team.

Nick Gentle

Business Owner & Operations Manager

nick@ifindproperty.co.nz

027 358 3855

Why Christchurch and Its Surroundings Tick So Many Boxes for Property Investors in 2026

A 2026 insight into the Christchurch property market for investors. Read More…

From Risk to Advantage: The Inspection Turning Point

Student Investment Property Strategy: Buy Below Value • Reduce Risk • Maximise Yield • Buy and Hold for Growth Read More…

Pets and Rentals – What Landlords & Tenants Need to Know

Whether you’re a landlord or a tenant, the way pets are treated under the Residential Tenancies Act (RTA) is about to change. Here’s a plain-language breakdown of what’s coming, what it means for you, and how you can prepare. Read More…