Blog > Doing the Numbers

New Zealand 2023 Election: Policies that Impact Property Investors

There are a lot of policies flying around with regards to tax, building, housing, social housing etc. We have summarized the main policies from each party that impact New Zealand property investors. Read More…

Introduction to Commercial Property

Watch the video of Peter Ambrose's introduction to commercial property for new investors. Pete shares what investors need to pay attention to and showcases two case studies of commerical property purchases. Read More…

Part 2: An amateur property investor's guide to navigating inflation

In part 2, we look at strategies to navigate through, and ultimately profit from inflationary periods. Read More…

Part 1: An amateur property investor's guide to navigating inflation

Inflation is back, politicians are fighting about it, interest rates are up, the tax rules are changing, there is war in Europe and we are still in a pandemic. The headlines remind you daily that There is Lots to Worry About. How can you possibly invest through all this? Nick shares his plan. Read More…

How to Generate Passive Income and Retire Early with Property

Over time, property investors can build up high levels of passive income and become "financially free". This article teaches how to visualise an early retirement and plan the property portfolio you need to achieve it. Read More…

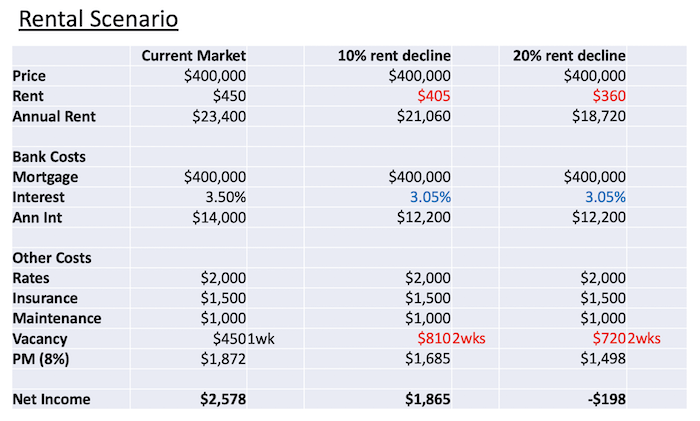

Cashflow and Cash during a Crisis

During a crisis the book as I see it is hold onto your assets and acquire more as you can, while sticking to rues and maintaining some flexibility. As a property investor it is about access to cash in the immediate term to handle a painful vacancy or job loss, while med/long term good cashflow is critical. Read More…

Securing A New Mortgage – What You Need To Know

Understanding the lending criteria applied by Lenders and using an experienced mortgage broker specialising in property investors are two things that can significantly increase your ability to capitalize on your borrowing power. Read More…

Ring Fencing Tax Losses 101 - Don't Panic

The government is changing the rules! Yes well they do that from time to time and now is when you should slow down and think about what is really going to happen.

Read More…

Wow, where has the time gone? We nearly through 2018 and the last 12 months has flown by. A fair bit has changed and I have a snapshot of where we are in the market. The new CVs come out in November and the expectation is for a massive increase compared with the 2015 CV we currently have. Read More…

Rotorua's Current Market Performance

In a recent news release Kelvin Davidson of CoreLogic waxed lyrical about Rotorua's property market performance and the strength behind this: Read More…

Case Study: Add bedrooms to increase yield and value

How a Wellington-based investor secured a property the entire market had missed - literally, it had been on sale for a year - and stands to make a fortune in doing so. Read More…

Use Leverage to Build Wealth and Passive Income

Property is the business of using leverage carefully to grow your wealth. In this article we look at the two main forms of leverage, "Other People's Time" and "Other People's Money". Read More…

Reducing Depreciation Recovery

Quite a few property investors are thinking about selling. Should you just accept that you will have to recover all the building depreciation you have previously claimed? ……… NO Read More…

Pros, cons and risks of short term rentals

We invited an investor, insurance advisor and property tax specialist to a round table discussion of strategies, pros, cons potential pitfalls when planning or running a short term rental investment in New Zealand. Read More…

Mortgage Market Update with Squirrel

iFindProperty spoke with Andrew Mackay and Peter Norris from Squirrel about what is changing in the mortgage market in 2017, particularly for investors. Read More…

A glimpse into what our team assists clients with during the due diligence period of a potential purchase. Just what is required to do your analysis in the time allowed takes a bit of experience and as you can see, there is often more to it than just emailing the contract to your lawyer and bank. Read More…

20 Rental Properties in One Year by Graeme Fowler

We interview best-selling property author and successful investor Graeme Fowler about his most recent book, 20 Rental Properties in One Year, now on sale at the iFindProperty website. Read More…

Case Study: Invest to Reduce your Mortgage

How a couple of young iFindProperty clients cut an estimated 8 years off their own home loan with a very affordable investment property purchase. Read More…

How to Identify TRUE Value in your Local Market

Most investors are familiar with the saying, "You make your profit when you buy."

So how do you consistently do this? There are a two very common schools of thought; firstly, to buy properties with high yield and secondly to purchase the worst house in the best street (or suburb)...

Read More…

.png)

.png)

.png)

.png)